Customer case

AXA: Making training consistent for a global insurance leader

Find out how AXA utilizes Rise Up to train subsidiaries and partners effectively within a highly regulated sector.

Digitalize your regulatory processes, strengthen customer culture and automate your obligations. With Rise Up, meet industry requirements while reducing your time-to-skill.

A PLATFORM TAILORED TO A REGULATED SECTOR

Cumbersome training requirements (DDA, KYC, LCB-FT, RGPD...).

Lack of visibility on the progress and completion of regulatory training.

Overly generic career paths, with little connection to business realities.

A proliferation of non-interconnected tools (CRM, HRIS, LMS, etc.).

A single platform to centralize, track and certify all your business and regulatory training courses.

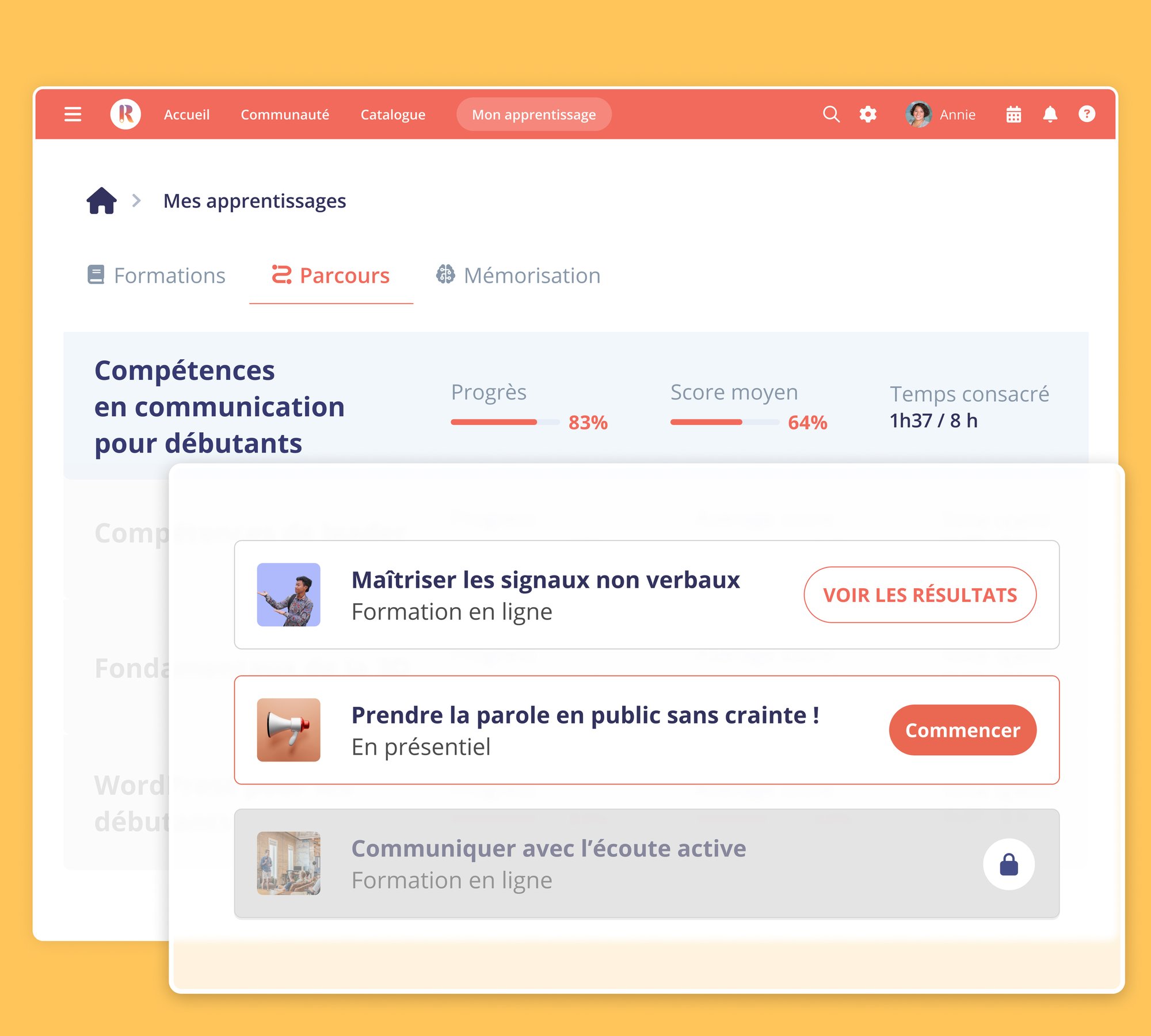

Adaptive, AI-powered career paths, customized to functions, roles and projects.

Seamless integration with your tools (HRIS, CRM, internal control tools, business tools).

Automated certificationmanagement and audit-ready reporting (ACPR, AMF, etc.).

Compliance and regulatory training

Ensure your teams' compliance with sector-specific obligations thanks to a platform designed for regulators' requirements.

Plan your mandatory training courses: create and automate courses according to requirements (DDA, Solvency II...).

Tailor content to profiles: adjust modules according to functions, products or distribution channels.

Ensure complete traceability: track training time and results, and automatically generate certificates and attestations.

Anticipate deadlines: automate reminders to ensure compliance with the 15h/year DDA.

Simplify your audits: access reliable exports and proofs of conformity in just a few clicks.

Finance professions

Target critical functions: train customer advisors, credit analysts, account managers, asset managers...

Reinforce product expertise: offer contextualized content on savings, loans, asset management, sustainable finance...

Combine formats: structure fluid blended learning paths by combining face-to-face, distance learning and e-learning from a single entry point.

Optimize engagement: use microlearning, quizzes and immersive formats to reinforce memorization.

Offer total accessibility: provide mobile or off-line access to courses, for your employees in the branch or on the road.

Insurance professions

Meet regulatory requirements: facilitate training in DDA, LCB-FT, RGPD or multi-channel distribution.

Anchor content in the real world: offer simulations of claims declarations, contract management or risk analysis.

Enhance business expertise: tailor content to your product portfolio (property & casualty, health, provident, life, etc.).

Efficiently train your network: accelerate the training of franchisees, distributors or brokers with dedicated sub-platforms.

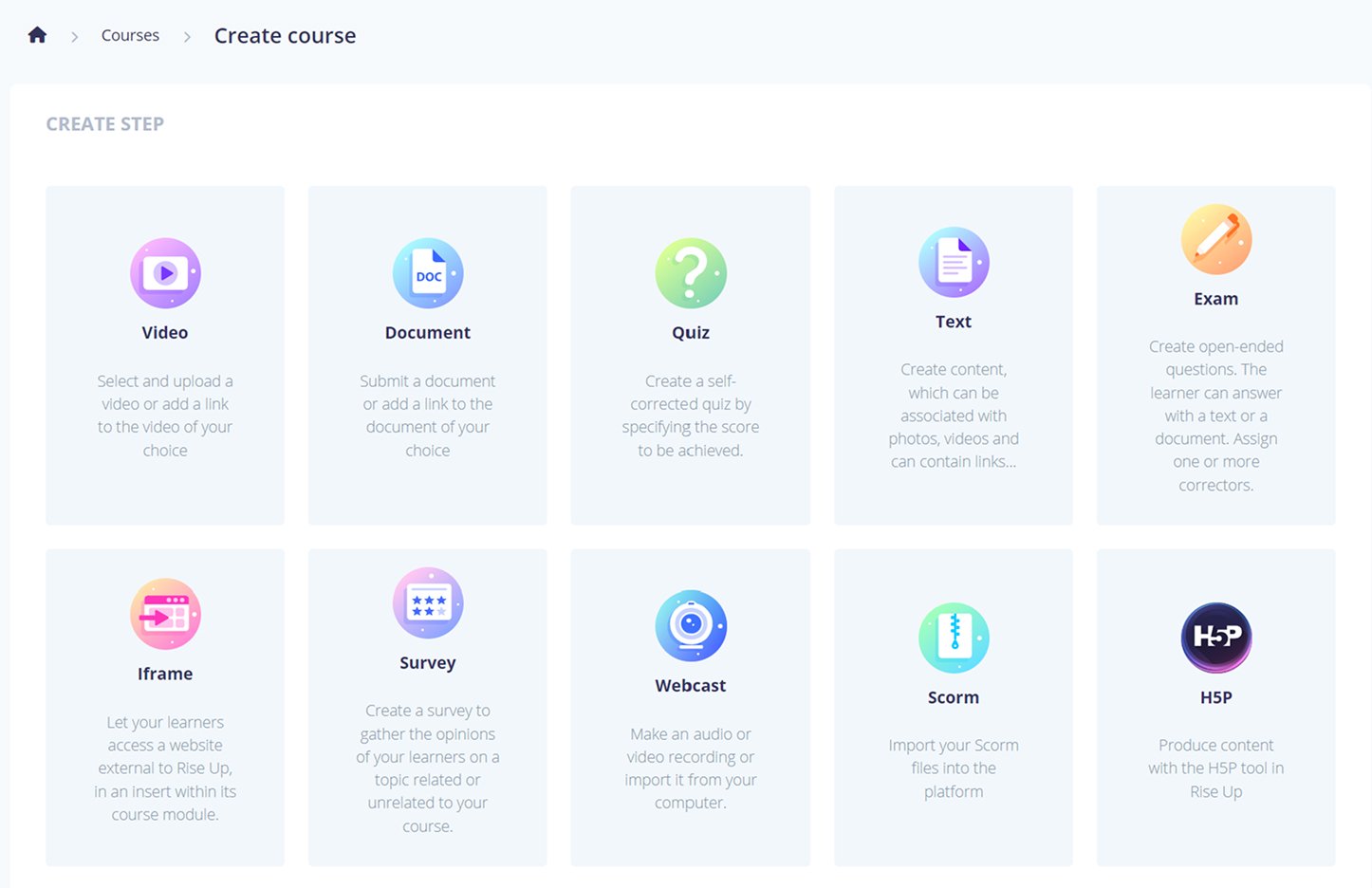

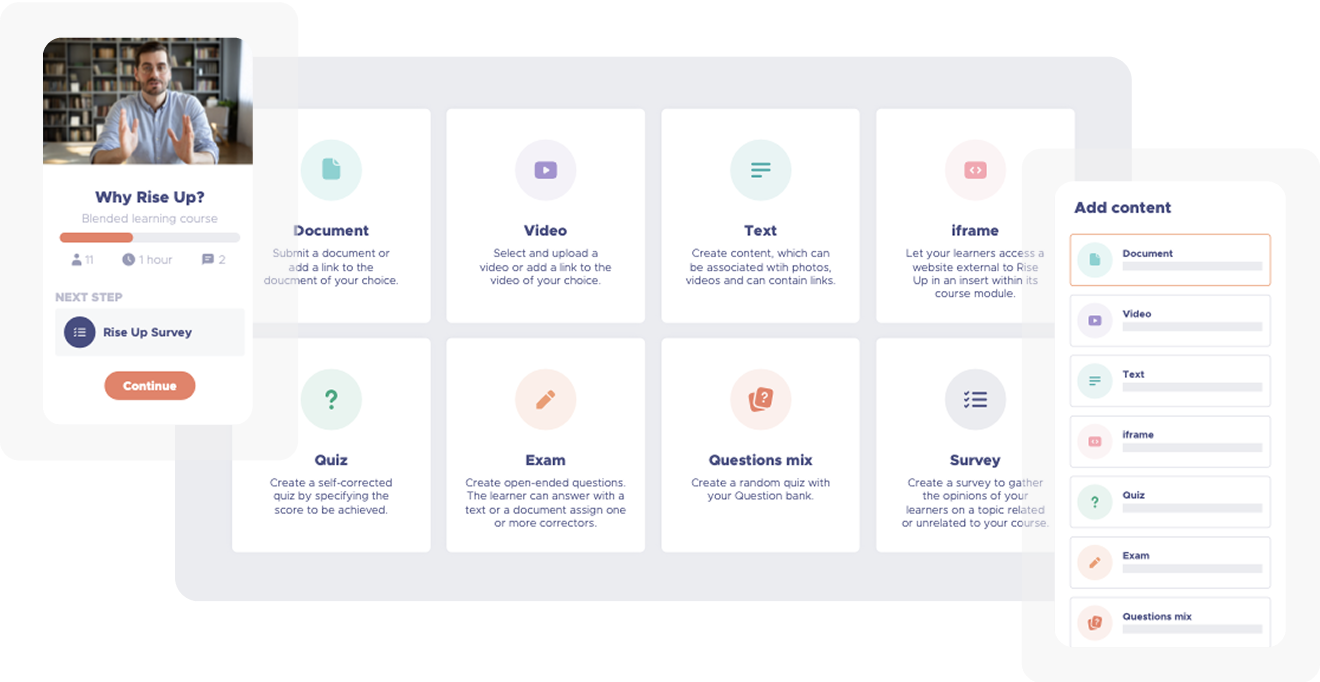

Content creation

Create content that is useful, concrete and aligned with your business challenges, to make training a real performance driver.

Create clear, engaging modules with our AI-assisted authoring tool.

Simplify understanding of complex concepts with interactive formats.

Access certifying content designed by leading banking and insurance publishers.

Integrate your existing SCORM content, enhance it and give it new life.

Find out how Ardian, a major player in private equity, has structured an ambitious, employee-focused L&D approach. With Rise Up, Ardian deploys personalized career paths, adapted to the culture of the financial sector and the challenges of developing talent on an international scale.

.png?width=2000&height=1587&name=Charlotte%20Ardian%20(1).png)

“This step is just the beginning, and our ambition is clear. Not only to support our employees in their development, but also to enable them to play an active role in their own progress. We aim to give them a sense of responsibility, to create a culture where everyone is committed to their own learning and contributes to Ardian's constant evolution. ”

Charlotte Girier

HR Learning Manager, Ardian

“Thanks to the integration of Rise Up into Teams, training has become a natural, fluid reflex, without interrupting work. It's a real performance driver for employees.”

Maureen Cilla

Training Manager, Opteven

Customer case

02 June 2025

Find out how AXA utilizes Rise Up to train subsidiaries and partners effectively within a highly regulated sector.

Customer case

04 June 2025

Learn how Raiffeisen Bank leveraged Rise Up's digital training to ensure staff compliance with regulatory requirements.

Customer case

04 June 2025

Discover how Action on Line uses Domoscio to personalize training paths and increase learner engagement with adaptive learning.

Customer case

04 June 2025

Crédit Agricole Assurances used Domoscio Hub to personalize training, automate skill learning, and save time.